On an uncharacteristically quiet Monday in the Raise Financial office, we were discussing an article about things that have disappeared from our lives without anyone noticing. Think waterbeds, phone books, toys in cereal boxes, etc. But then we were hit with an unexpected zinger: ownership.

That made us wonder, is ownership a thing of the past?

10 years ago, you purchased software at Sam’s club. You’d toss the latest version of “Microsoft Office” into your cart. Four years later you would do it again. Today, our software doesn’t come in shrink wrapped boxes, but like many things it's packaged as a subscription.

The model makes sense for some things. Take movies. Netflix put Blockbuster out of business almost overnight. Why? For consumers, films are an experience not an investment. After you’ve watched it once, the value diminishes.

Subscribers have access to a library of ever changing content and Netflix enjoys recurring revenue.

But some subscription models aren’t symbiotic.

Take storage. We used to back up our photos, work and music on hard drives. Unless it was lost or stolen, the hard drive and that content belonged to you. Today, we use cloud servers to store the same content. Here’s the catch: if you cancel your subscription, it all disappears. Unlike Netflix, these companies aren’t making monthly updates to your storage plans. They earn recurring revenue without any additional work.

It isn’t isolated to digital assets.

Subscriptions have changed physical ownership too. We rent or lease everything from cars to home to yes, even clothes (hello rent the runway).

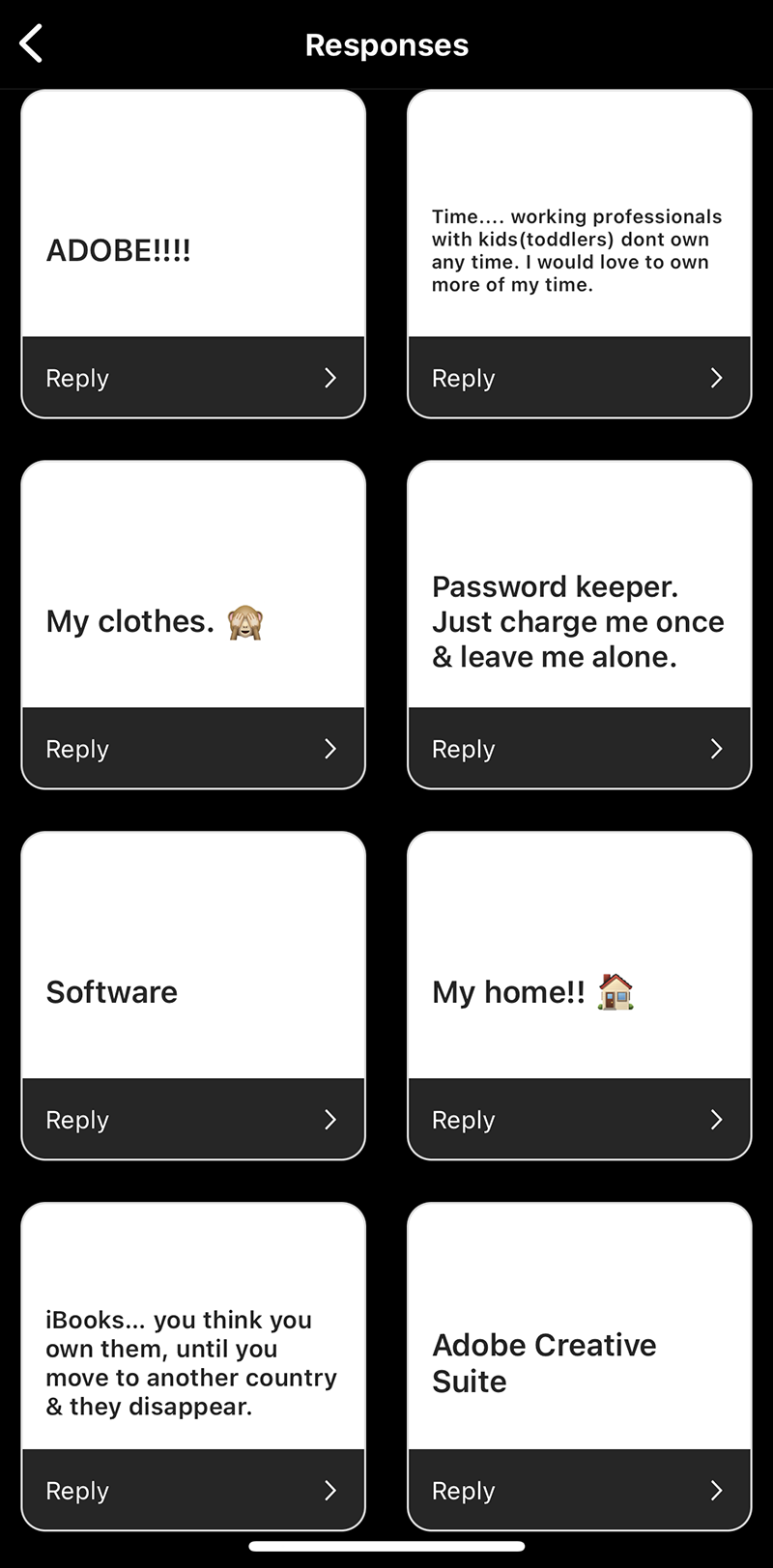

We asked our Instagram audience: What do you rent/subscribe to that you prefer to own?

Next we asked: What do you own that you wish you could subscribe to? The answer? Crickets. We didn’t receive a single response.

Why does ownership matter? Unlike subscriptions, ownership is not a fair weather friend. If you own it, it’s yours for life.

Homeownership is the most obvious example. When you buy a home it’s yours. If you decide to sell it, you reap the rewards of equity. Meanwhile, if you rent and decide to move, you have nothing to show for all those monthly payments.

The subscription economy is broadening the wealth gap. It cements those with less into continuously paying installments for things that other people or businesses own. It's rich vs poor, but it’s also owners vs. subscribers.

The gap isn’t all about money.

Ownership is the American Dream. The American Dream is building a life better than those that came before you.

It’s time to start owning this world instead of renting. No more life as a subscription service.

Raise is on a mission to redesign long-term financial stability for the individual. We offer a long-term investment membership, that is doing for stock ownership, what the mortgage did for homeownership. In exchange for a budget-friendly monthly membership fee, we invest a lump sum of our money in a total stock market ETF, so that you can collect the returns. We all know that with compounding returns, a big upfront investment is a game changer that can more than double the returns in your pocket over time. And what sets our membership apart from all of those terrible subscriptions (yeah, we said it, a lot of them are terrible) is that when you exit from your membership, you don’t walk away empty-handed. You get to keep 100% of the investment’s returns to date. Those returns are yours to own from day one, because you deserve to be able to create a stable foundation for yourself and your family.