Saving for college is within your reach

Overwhelmed with the thought of saving for your child's future? Start a free education savings plan with Raise Education and put those worries to bed.

How does it work?

If I can save

per

Raise Education

0

0

Savings Account

0

0

Save for school, smarter.

Jumpstart your child's 529 college savings account with the help of friends and family

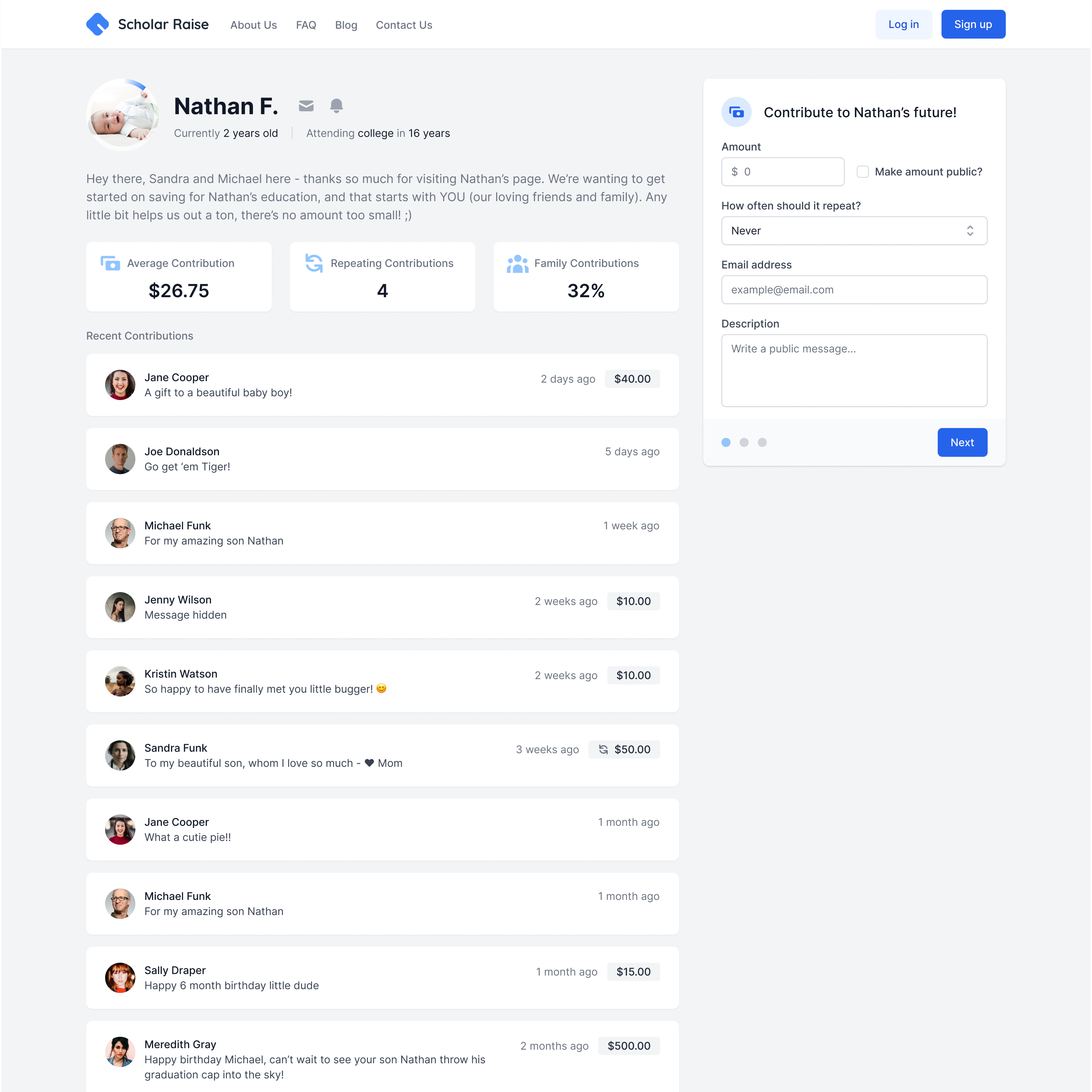

Get a little help from loved ones

It takes a village to raise kids and saving for their education is no easy task. With Raise Education, you can invite friends and family to contribute to your future scholars. Power in numbers equals powerful numbers.

"I love how easy it is to contribute to my child's future! And the ability to share his link with family and friends so that they can contribute for birthday or holiday gifts is an awesome advantage!"

Kailey B., Mother of one

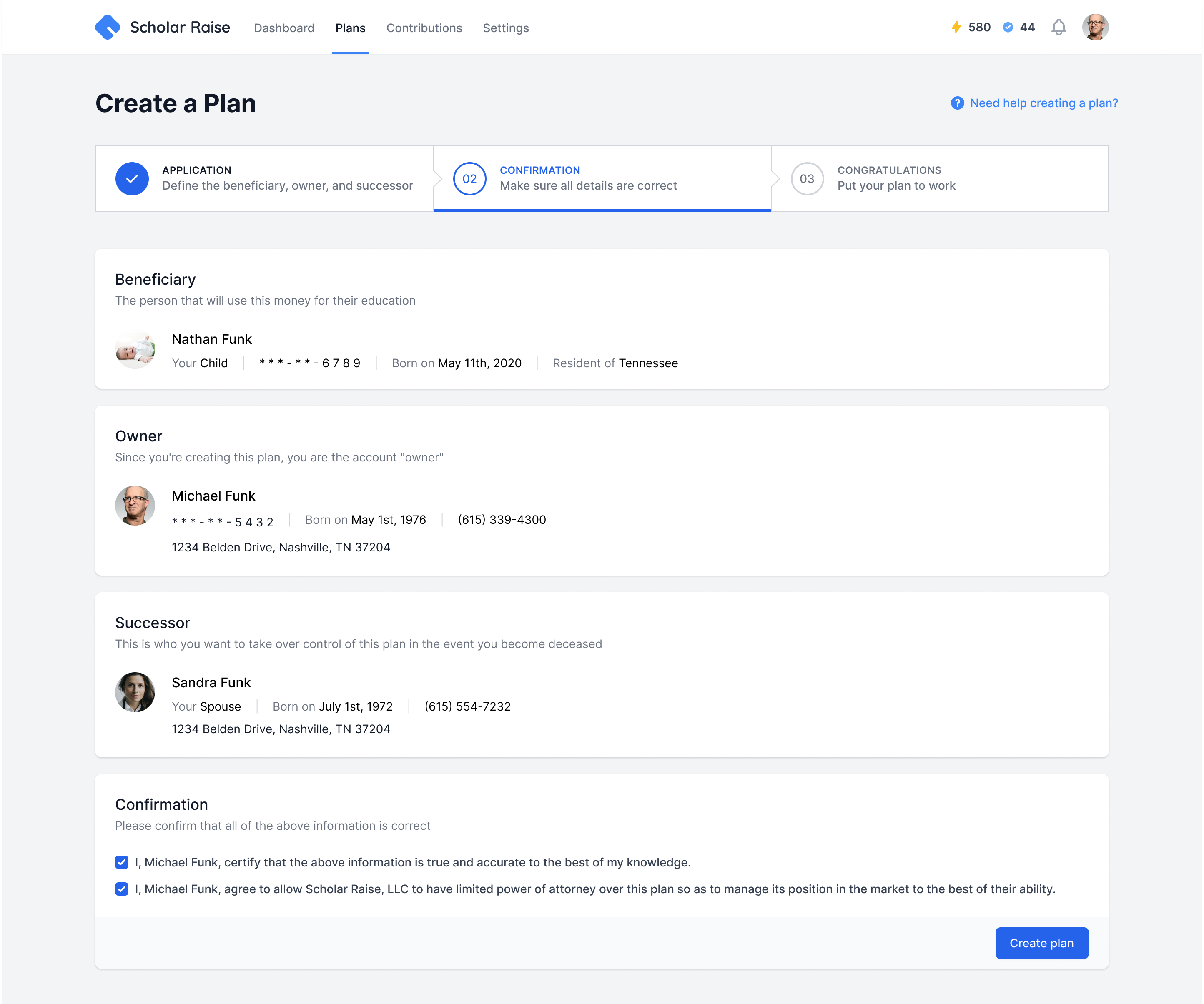

Free and fast forever

You can create your savings plan in less than 5 minutes and there is no minimum balance. We charge a 5% fee on contributions from friends and family, but you can contribute to your own plans completely free, forever.

"I love the ease of setting up the account and the flexibility of being able to provide a way for family and friends to add to my daughter's education. It so user friendly!"

Towanda W., Mother of one

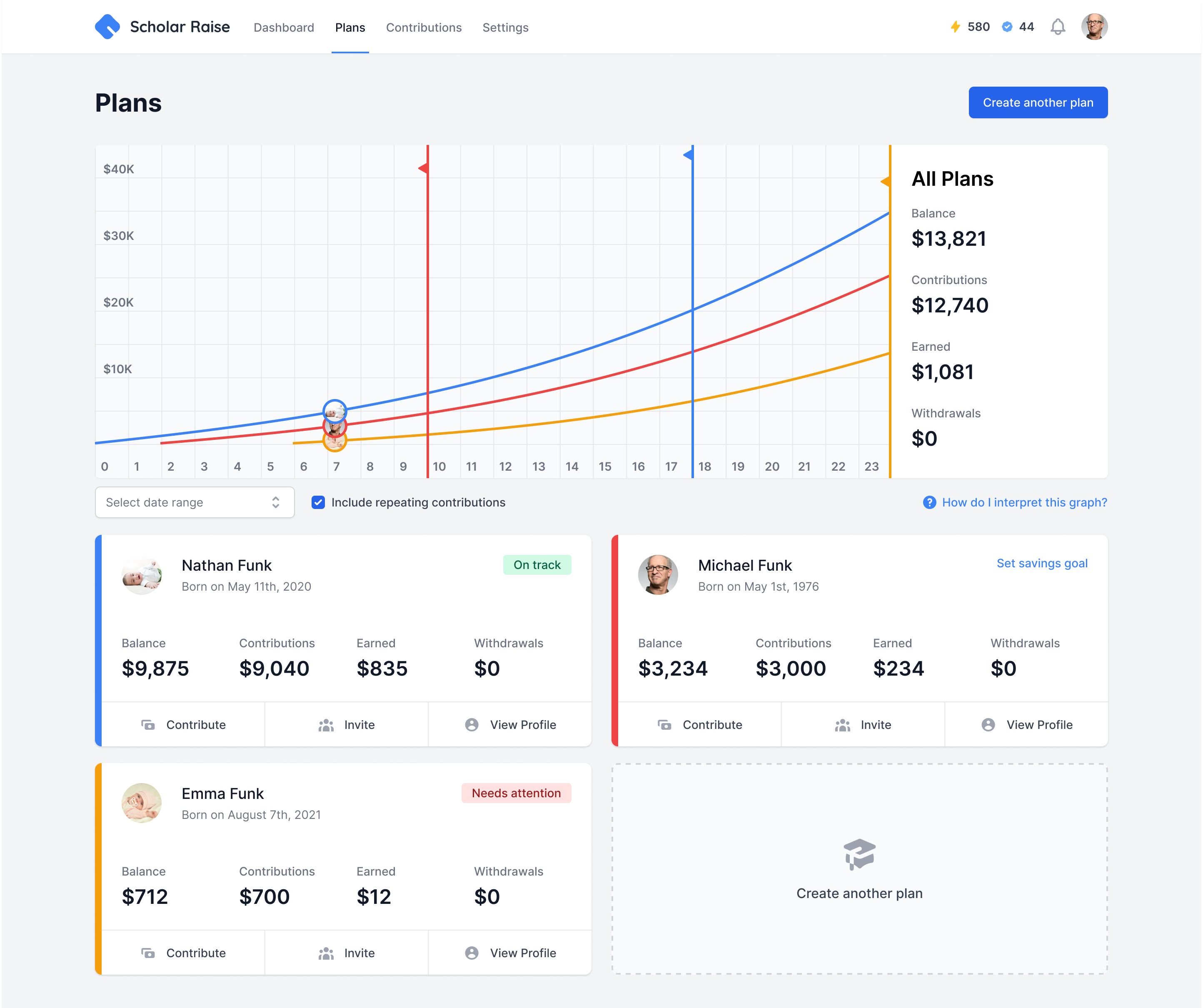

Tax-free, compounding returns

Our platform is built on state-run 529 education savings plans - that means that all earnings on contributions are tax-free. All interest you earn gets reinvested, which nets even more interest. Dolla dolla bill, y'all.

"As parents, we have enough that keeps us up at night... now the last thing my wife and I have to think about is being able to afford our kids' future education. Matter of fact, we trust Raise Education so much that we NEVER think about it anymore."

Casey D., Father of two

100% FAFSA friendly

All Raise Education accounts play nicely with federal student aid programs - so feel free to double dip, maybe even add some sprinkles while you're at it.

Repeating contributions

Want to double-down on a scholar's future education? Create a repeating contribution! You can stop or adjust at any time.

Share on social media

We think that saving for school is best done using the power of the crowd. Share your scholar's profile on social media or in an email blast!

Use on any school expense

Tuition, books, or meals at the caf? It's all covered with Raise Education. Better yet, we're accepted at any educational institution in the country!

Create unlimited savings plans

There's no limit on who you can save for. You can create as many savings plans as you would like for your child, a family member, or even yourself!

Planning? Pregnant? No problem!

With Raise Education, you can even create an education savings plan for children you're planning to have. Sounds like a great baby shower gift!

Save intelligently

Our algorithm automatically adjusts your portfolio's distribution as your child gets older, so they save the maximum amount possible.

State of the art security

Our team has spent decades building highly-secure financial solution. When it comes to security, your safety is our only concern.

We're on call

Our support staff is always there to help. Just click the support button at the bottom of your screen and a human being will be right with you!

“I love how easy it is to set it up and share with friends and family to help our kids grow their college funds. I also love that the staff is there to answer any questions I have and help get me answers!”

Mother of two

Keep every, last, penny

It's not our business to make your child our business

You & Your Spouse

Free

We don't think it's right to penalize you for saving for your child - so we won't.

Friends & Family

5% fee

When loved ones contribute, we add 5% to their contribution to keep the servers humming.

Still have questions?

For those who need more convincing, take a gander...

Why can't I just go out and do this myself?

Go for it! Anyone can start a 529 college savings account in any state they choose. However, we think you'll find that doing it through Raise Education is a whole lot easier. Plus, we give you the added ability to share your child's profile with friends and family to let the savings multiply!

Is this an investment?

Yes - the way 529 accounts work is that they deploy your savings into an investment account, which is comprised of various assets in the stock market. Fear not, investment of Raise Education portfolios is done according to the your child's age, so when they're younger the portfolio is more aggressive, but gets more conservative once they get closer to going to college.

How do your competitors work?

Typically speaking, other solutions out there charge you a management fee (monthly or annual) to keep your account going. We don't really feel that's fair. The vast majority of our expenses occur when people contribute, so we feel that charging friends and family 5% to contribute is better-aligned with your financial interests.

What expenses can a 529 account cover?

If it's related to education, it's covered. You can even pay for expenses related to private K-12 schools. So, books, tuition, room and board - all good. Picking up a few beers on the way to a house party - yeah, don't even think about it.

What is "Scholar Raise"?

Pardon our dust! We've recently migrated our Scholar Raise college savings product over to Raise Education. This change allows us to better serve our customers under the Raise brand going forward. Some older marketing material, like our brand video, still has the Scholar Raise branding. This is purely cosmetic. It's the same product and the same team.

(615) 517-2064 | 800 19th Ave S, 2nd Floor, Nashville, TN 37203

Raise Financial, LLC, a Tennessee Limited Liability Company, is an internet based investment advisory service. Our internet-based investment advisory services are designed to assist clients in personal investment and are not intended to provide comprehensive tax advice or financial planning. Our services are available to U.S. residents only. This website shall not be considered a solicitation or offering for any service or product to any person in any jurisdiction where such solicitation or offer would be unlawful.

Please consider your objectives and tax implications before investing with Raise Financial, LLC. All investments and securities involve risk. Raise Financial does not provide brokerage services.