The Federal Reserve has just reduced its benchmark interest rate, and you might be asking: “What does that mean for me?” Whether you have loans, savings, or plans to borrow, this shift in rates can ripple through your finances. In this blog break down what changes, what stays risky, and how you can respond.

TL;DR. Watch the 60 second video

here.

What Exactly Is the Fed’s Interest Rate?

The rate we’re talking about is the federal funds rate, which is the interest rate at which banks lend to each other overnight. That might sound abstract, but it’s a foundational lever: it influences all other interest rates; for mortgages, auto loans, credit cards, and more.

On September 17, 2025,

the Fed cut its target rate by 0.25 percentage points, bringing the range to 4.00%–4.25%.

In plain terms, the Fed thinks the economy’s cooling off and needs a little help to keep moving.

Borrowing Becomes a Bit Easier

When the Fed cuts its benchmark rate:

- Banks can borrow money more cheaply.

- They often pass part of that “cheaper money” to customers.

- Mortgages, auto loans, student loans, and credit cards can all see small interest drops.

For example, if you’ve been waiting on a home purchase, refinancing, or taking out a car loan, this cut can shave off interest costs, even if not dramatically.

The Trade-Off: Savers Lose, Inflation Risk Rises

It’s not all upside. Lower rates carry downside, too.

Lower Rates for Your Savings

Savings accounts, money market accounts, and CDs tend to yield less when the Fed rate is cut. That means the “safer” money you’ve parked in the bank doesn’t grow as fast.

Inflation Can Accelerate

If borrowing gets cheaper and people spend more, prices may start rising faster, especially if supply is tight. Inflation reduces the real value of money and can erode your purchasing power.

The balancing act is tricky: boost the economy without letting inflation get out of control.

Why the Fed Made the Cut

What pushed the Fed to act now? Two big

factors:

- Job market cooling: hiring growth has slowed, wage pressures easing.

- Signs of weaker demand: consumer spending and business investment showing strain.

To prevent a deeper slowdown, a modest rate cut acts as a stimulus. But

the Fed remains cautious, watching inflation and labor data closely.

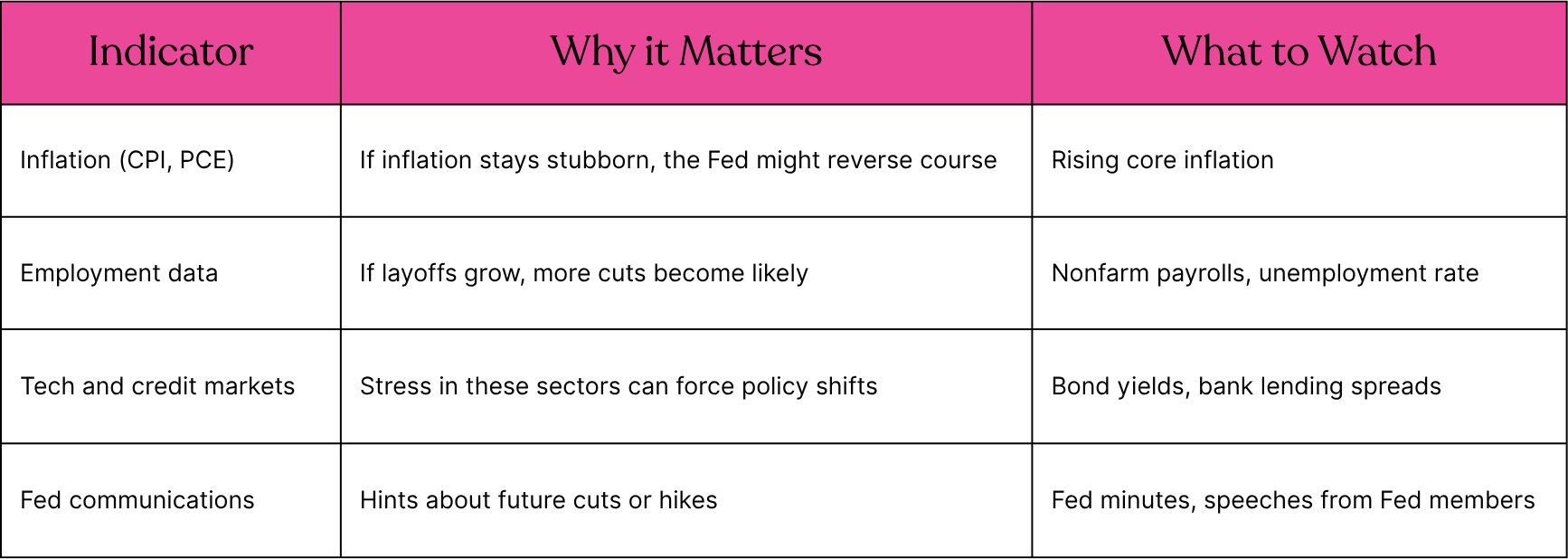

What to Watch Going Forward

Here’s what you should keep an eye on:

Things to Consider

Revisit borrowing decisions: If you have floating-rate debt or are planning a big loan, now’s a good time to shop around, or refinance.

- Adjust your savings expectations: Don’t expect high returns in high-yield savings accounts, consider investing.

- Stay flexible: Don’t lock yourself into rigid strategies. Be ready to pivot if rates rise again.

- Monitor inflation: Because it can erode long-term buying power, it’s one of the biggest silent threats.

A Fed rate cut isn’t just a headline, it's a real lever that touches your wallet, your loans, and your savings. In a changing economy, being informed can make a big difference.

Want to maximize your long-term returns with the power of upfront capital, without breaking your monthly budget?

Note: The information in this blog is for educational purposes only. It does not constitute financial advice.