A High Income, Still Feeling Stuck

If you have a decent to high income but still feel boxed in financially, Ashley Cheung's story will feel familiar. On paper, she's doing well. At 37, she lives in the Boston suburbs with her wife and their child, and works as a software engineer after starting her career in finance. She earns well, understands how markets work, and is smart with money. Yet she still felt stuck in a position many middle and upper-middle income households quietly occupy: earning too much to feel constrained, yet not enough to invest at the scale that really moves the needle.

Most of Ashley's income already has a job. Mortgage. Childcare. Everyday life. She wanted to invest more aggressively, but not at the expense of her family’s financial security. Drip investing small monthly amounts felt frustratingly slow. She knows how compounding works, and she also knows that market exposure in the early years matters most.

Ashley fits a profile that is becoming more common: high earner, not yet rich. Plenty of income, not much spare capital, and not much tolerance for downside risk.

A Different Way to Invest

Raise Investment caught her attention because it approached that tension differently. Instead of asking her to put more of her own money at risk, Raise offered upfront market exposure in exchange for a flat subscription. Ashley joined as part of the first beta group at $30 per month. At that level, Raise invested $5,000 upfront into the S&P 500 on her behalf, and she gets to keep all the returns.

The idea was simple enough to be interesting and unfamiliar enough to warrant a closer look. Her money was not being slowly built up over time; a lump sum was already working from day one.

Built-In Downside Protection

Another thing that appealed to Ashley about Raise, was how risk was handled. Because Raise is designed to give upside exposure while protecting users from downside risk, the investment is made through a buffered ETF. This type of ETF tracks the S&P 500 but ensures the value never falls below its initial purchase price. In other words, if the market drops, the investment does not sink below where it started.

The Long-Term Impact of Starting Ahead

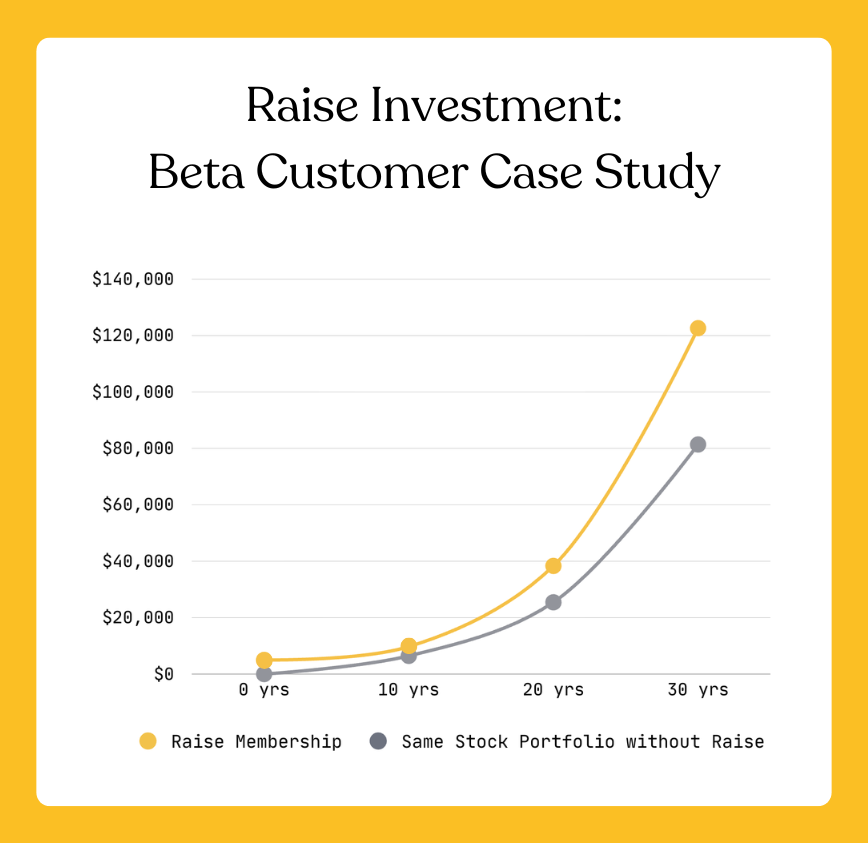

Over time, the difference between investing with Raise or without becomes significant. If Ashley stays invested for 30 years, the $5,000 upfront exposure provided by Raise is projected to earn her $41,224 more than investing the same $30 per month directly into the S&P 500. Same market. Same long-term horizon. Different starting point.

After watching the model play out in practice, Ashley’s confidence grew quickly. As she put it, “I tried Raise because it felt genuinely different and the downside was clearly controlled. After seeing how the model works in practice, I want to move beyond the $5k beta and into a higher subscription tier.”

For Ashley, Raise is not about taking a gamble or betting on a trend. It's about adopting a solution built for her financial reality, not an outdated one. She did not need motivation or education. She needed earlier exposure without added budget strain and unnecessary risk.

Her experience reflects what many households are quietly navigating right now. Strong incomes, careful planning, and very few tools that bridge the gap between where they are and where they want to be.

Raise Investment allows Ashley to start ahead while keeping her monthly costs fixed and without risking what she has already built.

This post is for educational purposes only, and does not constitute financial advice.