Trump Accounts have officially moved from headlines into the tax code. With the release of

IRS Notice 2025-68, families finally have clear guidance on what these accounts are, how they work, and how they compare to more familiar tools like

529 plans and

Roth IRAs.

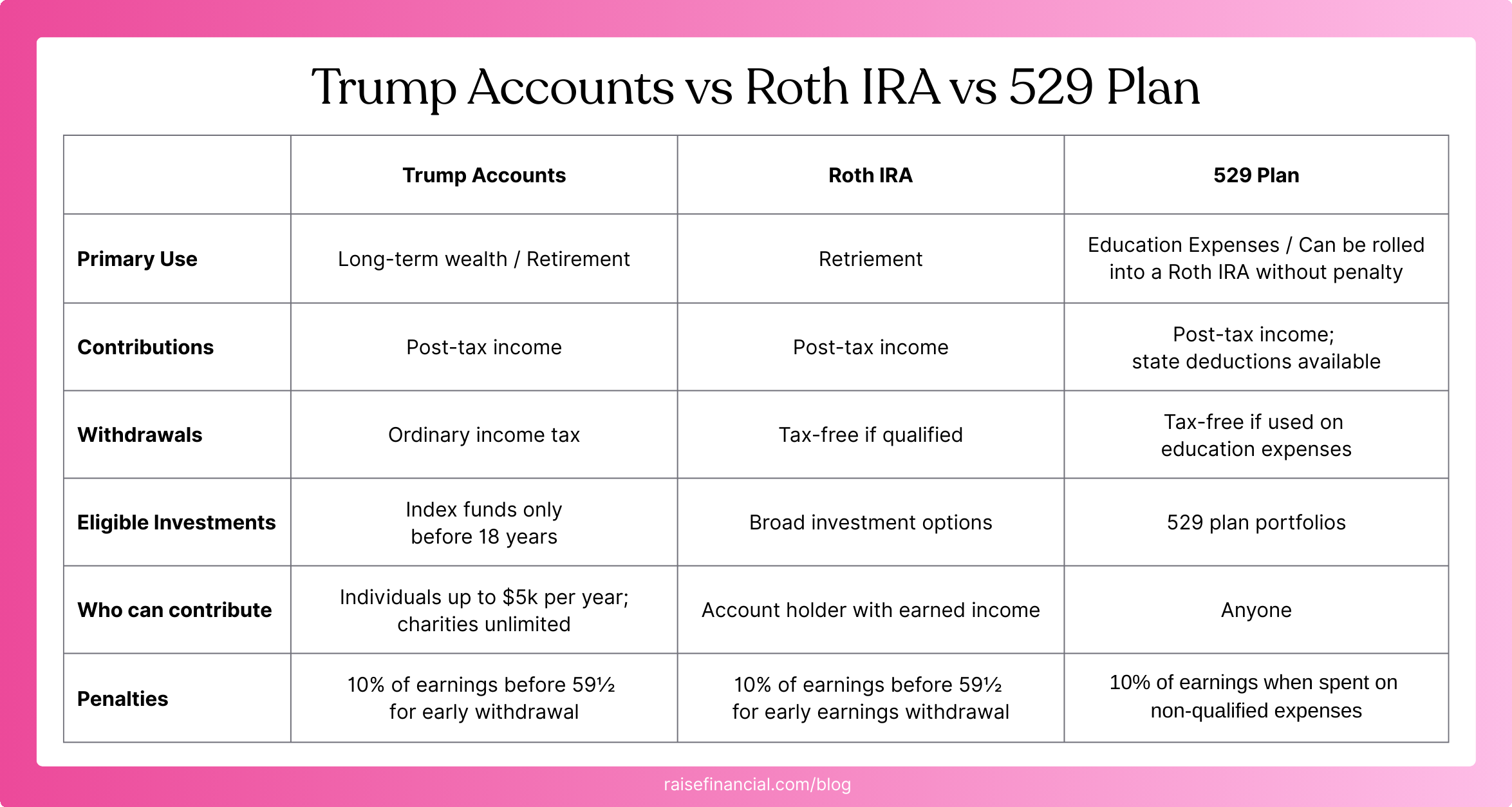

This is important, because a Trump Account is not just another savings vehicle with a new name. It is a very specific structure that blends elements of custodial investing and retirement accounts. The rules are strict during childhood, and the long term implications can be meaningful if the account is used strategically.

What is a Trump Account

According to

IRS Notice 2025-68, a Trump Account is defined as a traditional IRA that is established for the exclusive benefit of an eligible individual and formally designated as a Trump Account. It sits inside the IRA framework, but with customized rules that apply while the beneficiary is a minor.

Eligibility is narrow and clearly defined. The child must not have turned 18 by the end of the taxable year, must have a valid Social Security number, and must have an election filed on their behalf.

How to open a Trump Account

Opening a Trump Account starts with filing

Form 4547 with the Internal Revenue Service. The form includes basic identifying information for the child and the responsible adult, along with an election indicating whether the child should receive the federally funded contribution.

For children born between 2025 and 2028, that contribution is $1,000, provided all eligibility requirements are met. Once the election is filed, a participating financial institution opens the account and administers it according to the rules in Notice 2025-68.

Eligibility for the Federally Funded $1,000

The federal $1,000 contribution is very specific and not automatic. To qualify, a child must be born between January 1, 2025 and December 31, 2028 and must not have turned 18 by the end of the year in which the election is made. The child must have a valid Social Security number issued before the election is filed, and a qualifying Trump Account must be opened at a participating financial institution.

The contribution is a one time federal deposit per eligible child. There are no income limits, no employment requirements, and no geographic restrictions. If any of the required steps are missed, the child permanently forfeits the federal contribution.

Contribution rules during childhood

On the surface, Trump Accounts resemble IRAs. The contribution rules, however, are very different.

All contributions are made with after tax dollars, and there is no federal income tax deduction. Parents, grandparents, and other individuals may contribute up to $5,000 per year per child.

Qualified 501(c)(3) organizations may contribute without a dollar limit. This is how large philanthropic pledges, including those announced by families like

the Dells and

Ray Dalio, are structured. These contribution limits are unique to Trump Accounts and do not follow standard IRA caps.

Investment and withdrawal restrictions before age 18

The years before age 18 are defined as the growth stage, and this is where the account is most tightly controlled.

Investments are limited to index funds only. Active trading, individual stocks, and alternative investments are not allowed. No withdrawals are permitted for any reason during this stage.

Earnings compound on a tax deferred basis, and there is no annual tax reporting for the child. The structure enforces long term, passive investing and removes the possibility of early withdrawals or misuse.

What happens after the growth stage

Once the beneficiary turns 18, the account begins to function more like a traditional IRA.

Distributions are allowed, but they follow standard traditional IRA rules. Withdrawals before age 59½ are generally subject to ordinary income tax on earnings, plus a 10 percent early withdrawal penalty unless an exception applies.

At this point, the assets may be transferred into a traditional IRA in the beneficiary’s name. This transition is where more advanced planning opportunities come into play.

The advanced strategy wealthy families are considering

For families who can fully fund education and still invest aggressively for the long term, Trump Accounts create a pathway that did not previously exist.

If $5,000 is contributed each year for 18 years and earns a real return of about 7 percent, the account could grow to roughly $170,000 by age 18. After the growth stage, those assets can be transferred to a traditional IRA and then converted to a Roth IRA. Income tax would be due at conversion, typically at the child’s tax rate, which is often low in early adulthood.

From there, growth inside the Roth IRA is tax free. Over several decades, this can translate into millions of dollars in tax free retirement assets, something that standard Roth contribution limits would never allow.

This strategy does not replace a 529 plan. It complements it, and only for families with the cash flow to do both.

Trump Accounts are not universally better than 529 plans, and they are not substitutes for Roth IRAs. They represent a new lane. For most families, the education focused tax benefits of a 529 will remain the priority. For higher net worth families who already fund education and want to shift long term compounding into a child’s future tax bracket, Trump Accounts introduce a powerful, tightly regulated option that did not exist before.

The future is bright

If you are thinking about how to start building your child’s future today, a crowd fundable 529 plan can be a simple first step. With

Raise Education, you can open a 529 plan and invite grandparents, family members, and friends to contribute alongside you. It allows your village to participate in a meaningful way while keeping the tax advantages of a traditional 529 plan. Signing up is free, takes less than five minutes, and creates an easy way for others to help support your child’s education and long-term wealth building opportunities.

This post is for educational purposes only, and does not constitute financial advice.